Unlock Higher Yields with Secure and Scalable Lending

Join the TDX Yield Aggregator and access secure, high-yield investments with Syrup Lending. Powered by Maple Finance, Syrup offers secure, institutional-grade lending with flexible commitment options.

A single platform that delivers it all. No swaps, no extra KYCs, just effortless investing!

High-yield lending pools

Earn passive income

Track your returns

Simple & Secure Investments

Supported assets: USDT & USDC

Minimum investment: $25

Maximum investment: $50,000,000

No-commitment investing, allowing easy deposits & withdrawals with full flexibility

Simplified Investment Process

Upon investment, funds are transferred via smart contracts to the Syrup Vault

Syrup performs TRM and AML checks automatically before depositing funds

Investors receive real-time updates and a success notification

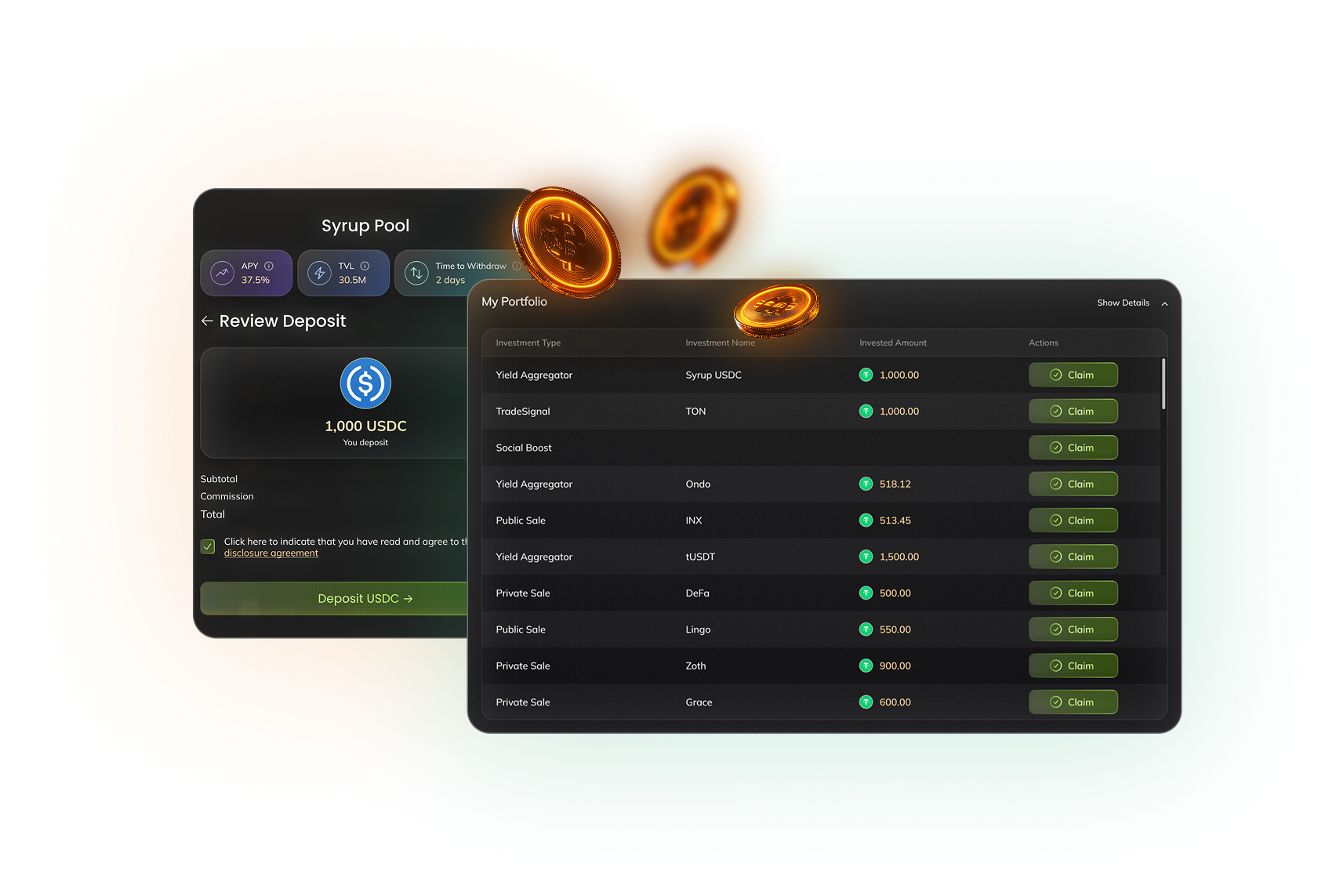

Earnings & Dashboard Overview

Investors can track interest earned, drips accumulated, and investment history in their personalized dashboard. Invoices and transaction history are also available for easy tracking.

Withdraw with Ease

Processed efficiently, depending on liquidity availability

Investors can withdraw in the same token they initially invested in

Minimum withdrawal amount: $10

Why Choose Syrup on TDX?

No swaps, no extra KYCs. TDX handles all complexities for you

Smart contract-based execution ensures security and efficiency

Competitive returns with flexible investment options

Full visibility into your portfolio performance

Frequently Asked Questions (FAQs)

What is Syrup Lending, and why is it integrated into TDX?

Syrup Lending, powered by Maple Finance, is a decentralized lending protocol offering high-yield investment opportunities with robust security. By integrating Syrup into TDX Yield Aggregator, we provide investors with seamless access to institutional-grade lending while ensuring transparency and security.

What assets can I invest in?

Investors can allocate USDT or USDC to Syrup’s lending pools via TDX.

What are the minimum and maximum investment amounts?

Minimum investment is $25 and maximum investment is $50,000,000.

Are there different investment commitment options?

Currently, investors can choose the “no commitment” investment option only.

How does the investment process work?

Step 1: Choose your investment amount and select USDT/USDC.

Step 2: Review available options such as APY, TVL, and liquidity.

Step 3: Connect your wallet and complete KYC verification (if required).

Funds are transferred via smart contracts to Syrup Vault, where compliance checks are performed.

How can I track my earnings?

Your TDX Dashboard provides real-time insights, including:

- Potential Interest

- Investment history & invoices

- Transaction logs

Can I withdraw my funds anytime?

Yes, the “no commitment” investment option allows you to withdraw your entire invested amount at any time in the same token (USDT/USDC) that you initially invested. Partial withdrawals are not allowed.

No KYC required to invest in Syrup

KYC verification is one-time before investing, and TDX does not require any additional KYC.

Are there any restricted countries?

Yes, due to compliance regulations, users from the following countries cannot invest:

- Abkhazia

- Afghanistan

- Angola

- Australia

- Belarus

- Burma (Myanmar)

- Burundi

- Central African Republic

- Congo

- Cuba

- Crimea

- Ethiopia

- Guinea-Bissau

- Iran

- Ivory Coast (Côte d’Ivoire)

- Lebanon

- Liberia

- Libya

- Mali

- Nicaragua

- North Korea

- Northern Cyprus

- Russia

- Somalia

- Somaliland

- South Ossetia

- South Sudan

- Sudan

- Syria

- Ukraine (Donetsk and Luhansk regions)

- United States

- Venezuela

- Yemen

- Zimbabwe