Defi Made Simple & Smarter

A one-stop hub to explore, compare, and invest in DeFi. TDX simplifies yield farming, with future plans to introduce Credit Pools, Digital Bonds, Stablecoins, Commodities, and Tokenized Stocks. All from one dashboard.

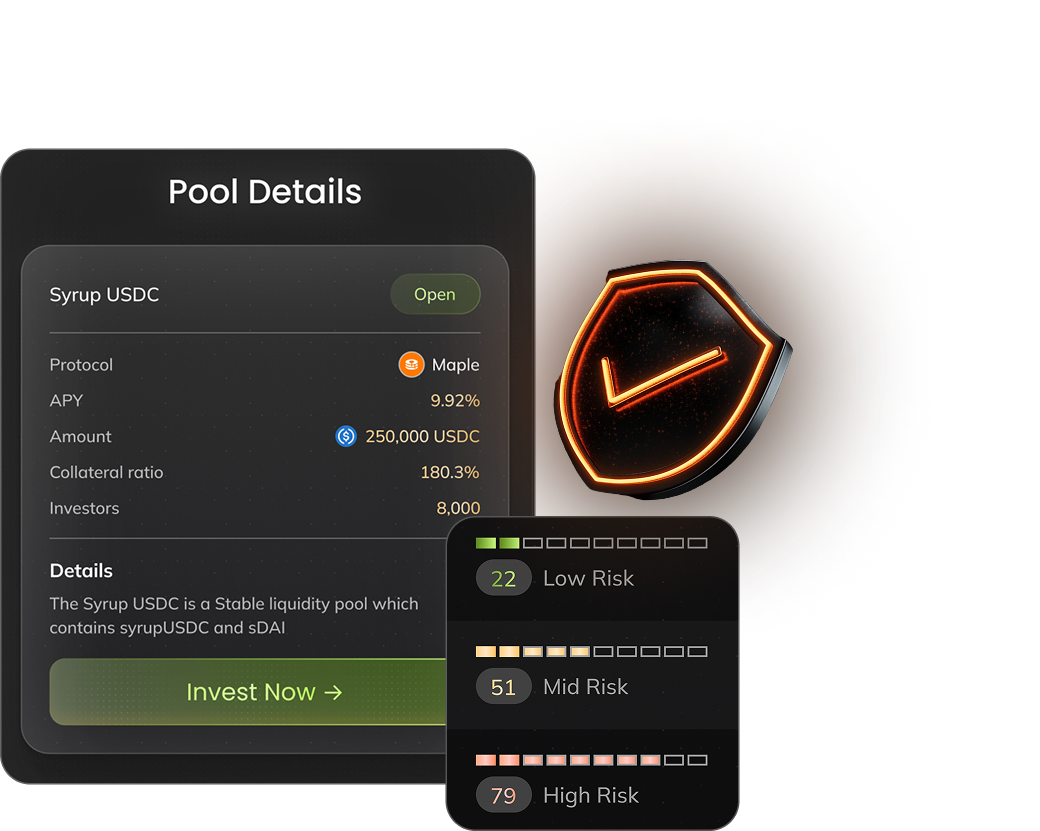

Investment Opportunities

Syrup

Syrup yield is generated by Maple’s digital asset lending platform that provides fixed-rate, overcollateralised loans to institutional borrowers

Why TDX Yield Aggregator?

User-Friendly

Navigate DeFi with a simple, intuitive interface designed for all experience levels. Enjoy hassle-free investing without complex setups.

Diverse Investment Options

Choose from a range of strategies to balance risk and return. Future offerings will include Credit Pools, Digital Bonds, and more.

Unified Dashboard

Explore, compare, and invest in top DeFi yield products from one place. No need to juggle multiple platforms or wallets.

Transparent & Secure

Stay in control with real-time tracking, risk insights, and robust security measures to protect your assets.

How it Works?

Browse High-Yield Investment

Easily compare APY, TVL, market cap, and other crucial metrics before investing

Invest in Just a Few Clicks

Choose USDT or USDC, enter your amount, and confirm. No complex steps are required

Earn Yield Effortlessly

Watch your earnings grow as your funds work for you

Who Is It For

New Investors

The TDX Robo-Advisor crafts bespoke investment strategies, aligning with your risk profile and goals. AI-driven asset allocation makes wealth creation more personalized, effective, and efficient

Experienced Yield Farmers

Want optimized returns without the headache of manually tracking yield pools? TDX has your back.

Institutions & Large Investors

Need a trusted, scalable yield aggregation solution? TDX offers secure and high-liquidity investment opportunities.

Transparency & Security You Can Trust

On-Chain Visibility

Track real-time yield performance, portfolio growth, and transaction history at any time

Non-Custodial & Secure

Your funds remain in your control, eliminating third-party risks

KYC-Verified Access

Data on risk, security, and incentive strategies into powerful tools to guide the evolution of decentralized finance

AI-powered risk Monitoring

Detects market shifts and optimizes yield opportunities in real time

Instant Liquidity Insights

Always know the available liquidity status before making withdrawal decisions

Frequently Asked Questions (FAQs)

What is TDX Yield Aggregator?

The TDX Yield Aggregator platform is designed to streamline DeFi investing. It allows users to explore, compare, and invest in various high-yield opportunities, such as lending pools, digital bonds, and stablecoins. Investors benefit from automated portfolio optimization and one-click investing.

What assets can I invest in?

The TDX Yield Aggregator supports investments in USDT and USDC, enabling access to a diverse range of DeFi products, including on-chain credit pools, with future offerings in digital bonds and stablecoins.

What are the minimum and maximum investment amounts?

It varies from lending pool to pool, with a minimum as low as $10 and a maximum investment of $50,000,000.

How does the investment process work?

Step 1: Select an investment amount in USDT or USDC.

Step 2: Review available yield opportunities, including APY, TVL, and liquidity.

Step 3: Connect your wallet.

Funds are transferred via smart contracts to Syrup Vault, where compliance checks are performed.

Can I withdraw anytime?

Yes, the no-commitment investment model allows full withdrawals at any time, with funds returned in the same token (USDT or USDC).

Are there any restricted countries?

Yes, due to regulatory compliance, TDX restricts investments from certain regions, including the United States, Australia, Russia, North Korea, Iran, and others.